Have you ever wanted to get into investing but have no idea where to start? The investing world is massive and worth billions and placing that first tentative step into that world can be very scary indeed. The new app Moneybox has been designed to make those first baby steps more easy then you could have imagined.

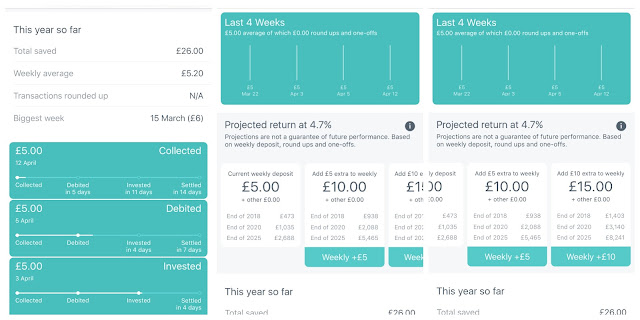

The app is really simple to use, you register and create a password and a pin. Once you've signed in you can set up a Direct Debit to move over a certain amount of money into your savings each week. How much you save is entirely up to you but it can be as low as a £1. I started off with £5 a week but it gives me the option to increase that in order to increase my returns. In a couple of weeks I've invested a small amount and earnt 0.09 on my savings. It doesn't sound a lot but it all adds up! The app also gives you the opportunity to round up purchases you make and add more to your savings with the extra. For example say you spent £1.98 on a sandwich, the extra £0.02 will go into your savings pot. Not all banks cater to this function though so not everyone can use it at the moment, me included.

With Moneybox you can have a number of different accounts including a Stocks and Shares ISA (the most common) and a General Investment Account. They'll also shortly be opening a Lifetime ISA. As I've already got a stock and shares ISA I opted for the General Investment Account ("GIA"). Unlike a Stocks and Shares ISA there's no limit on the amount you can invest in a gia but it is taxable. Moneybox splits your money into three pots - the cash fund (Henderson Cash Fund), Global Equities Fund (Vanguard Global Equity Fund) and Global Property Shares Funds (Blackrock Global Property Shares Fund). By clicking on investments you can find out which channel your monies have been allocated to and your returns on those.

You can choose what sort of risk you want to take, low, medium or high and your funds will be invested into a appropriate account. You'll also get occasional emails or notifications from Moneybox letting you know you own a bit of real estate. It's a cute little touch I haven't seen elsewhere.

It costs £1 per month to use the app (free for the first 3 months) and you'll also pay 0.45% value of your investments per year which is charged at the end of the month. You'll also have to counter in 0.23% fund management fees for Vanguard, Henderson and Blackrock.

Moneybox is a little slow in investing your savings and it can take a week or so after they take your money by Direct Debit to go through the process. This can be a little annoying but you're still going to benefit in the long run.

Whilst I do have other savings accounts it's quite exciting to log in and see the money my savings makes on the stock exchange. Of course it's not risk free and the capital can go down so it's best to only put in what you can safely lose.

You can download the app for free on the app store

No comments

Post a Comment